Results of the 2023 Industry wide survey

Year on year the confidence of delivering the transition decreases

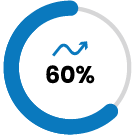

- Overall, the confidence in the energy sector has decreased to 40% vs 50% in 2022

- Women are more confident in the transition than men

- Oil and gas professionals more confident than others

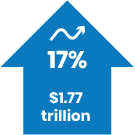

HOWEVER the sector is still more confident than the general pop with only 17% confident that the UK can deliver net zero*

*DESNZ public attitude tracker summer 2023

Why do Respondents say their confidence decreased?

External political and environmental challenges: eg war in Ukraine, energy poverty

Infrastructure and Policy Constraints: can the current infrastructure to support the transition?

Carbon Storage and Emission Reduction Challenges: No penalties on emitting carbon mean no incentives to make investments

Doubt in Meeting Targets: is it too late?

Lack of support from the Government and consistent Polices

Respondents also question Established energy company’s commitment to net zero:

- Are they only investing in net zero for incentives and so financial intuitions will fund them

- Are they just focusing on maximising ROI on hydrocarbon assets and focused on short term

What Leaders should take away from the sector drop in confidence

- This decreasing is aligning the sector closer to the general population and

AND

- The sector is realising that the energy transition is more complex not just about technology or investment and becoming more realistic about the challenges ahead

As a leader this is an opportunity to bring focus to your organisation as it will be hard and will require behaviour change as well as technology and investment

More new people and investment levels have increase to support the Transition

- 17% increase in investment in net zero investment to $1.77 trillion this year exceeding oil and gas investments

BUT

- drop in PE funding and respondents felt harder to access funding this year

More people working with people new to the sector 60% but people feel it is hard to enter the sector

65% of people are driven to work in the sector by the importance energy has and the need to transitio

*Bloomberg NEF

BUT respondents' confidence in leadership and the overall readiness of the sector has dropped?

Confidence in the leadership of the energy sector has dropped from 82% confidence in their leaders to 42% this year

Just starting to get ready

Overall people’s confidence in readiness has dropped with most people feeling we are just starting to get ready

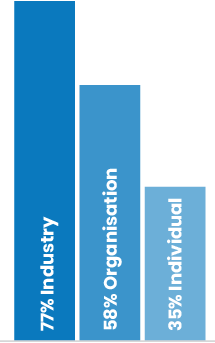

Overall people feel we are more ready as an industry vs and organisation and both of those more than they are as individuals

What Leaders need to consider overall

CASE FOR CHANGE

How are you articulating the future to your organisation and team?

USE OF RESOURCES

PEOPLE

- Why are women more confident about the transition and how is your organisation utilising that?

- How are you making it easier for people new to the sector? How are you integrating them? And learning from them?

INVESTMENT

- How are you balancing the investment for the future vs delivering for today

- How are you tracking the results on your investment and adapting?

READINESS TO CHANGE

How are you pivoting to future needs? Digital? Changing business models?

Established energy companies 2024 stats

Same top areas of business focus as 2022

65% delivering core fossil business

50% delivering agile business models

Same top challenges as 2022

96% lower commercial model

92% on speeding up decision making

Decrease in focus on

Acquisitions 34%

Creating new products and services 11%

Increase in the challenges of

Sharing data and automation 70%

Established energy companies

- 58% of people feel that their companies have the right mix of investment

HOWEVER

- a 1/3 of respondents would like to see more investment in net zero BUT felt there aren’t enough good investments out there

What does this mean for Established energy leaders

….a shift in strategy

- With Fewer acquisitions a focus on embedding acquisition, synergies and organic growth:

- 80% of transitions fail so it’s all about the people and cultural factors

- Integrating small entrepreneur companies into large companies remember and focus on what you are acquiring. Large scale process and decision making that works for your company may destroy value in the acquired company

IT and digitisation are coming fast and something problematic for large companies with larger integrated IT systems which are costly to integrate and update

Data is key what is your critical data that gives you a competitive advantage and how are you protecting it? What can you share and what are you doing to make it easy to share so that you can benefit from others and increase value

AI is adapting fast, and while it still will produce some false information, now is the time to investigate and experiment to define your AI strategy and what value it can bring to you

What does this mean for Established Energy leaders a shift in business model…

Faster decision making is another fundamental shift in the larger companies and this is coupled with managing the risk of making decision in a “new world”.

Investments in net zero world should not have to face the same hurdles as known investments.

There is also an unconscious bias to known areas vs unknown net zero areas

A net zero world has a lower margin than a typical upstream deal so focus on reducing operating costs, efficiency and effectiveness is needed and the scale of this means not just tinkering around the corners but a fundamental change in how you operate

Lower margins, taking on more risk, not gold plating how can you change things- what sacred cows can you challenge, where is your cost?

Next Gen companies are growing but finding it harder

96% of respondents said demonstrating returns was the biggest challenge followed by establishing themselves as credible in the sector

77% of people said Investment in the energy sector was a challenge which was up from last year (58%)

40% of people said funding was the biggest challenge to scaling up, despite the increase in investment

The other challenges are

finding the right skills and

people and adapting processes and procedure

Overall people feel it is harder

for new entrants 50% vs 60%

last year

What next Gen leaders need to know

Despite the increase in funding in the net zero sector, this has come with more rigour which is good for the sector so leaders need to be clear on

Commerciality

Deliver on plans and strategies

Scale up challenges

Remember it’s about company culture and fit, many new roles previously didn’t exist so it’s not about skills you are recruiting for but the culture and ability to learn

Processes and procedures need to grow with the company having a framework that is added to and knowing when they need to be enforced and when to adapt

Diversity of thought is game changer in innovation and solving problems SO don’t recruit mini mes, focus on an inclusive culture

AND listen to those outliners and challenges to your thinking they may well bring a game changer to the business

Individuals and future leaders of the sector

- 65% of respondents see the energy transition as an opportunity to have a career with purpose

- 65% are driven by the importance that energy has

- Only 34% of people say they work in energy because of the financial reward

- Only 4% of respondents are looking to exit the sector

- This activity again is not matched by companies with an increase of companies doing nothing 35% of respondence (2022 16%) and a decrease in companies sharing strategy and what it means for individual 35% (vs 60% in 2022). More encouragingly there has been a small increase in the number of career conversations

Again individuals are actively working on their future careers, networking, learning tech and new skills

This year there has been a decrease in how much clarity despondences have of their future career

What people leaders need to know

Energy is an attractive sector for people

In the last 2 years purpose and importance of energy is why they work there

- Decrease in clarity on future careers is felt this year

SO

- Initiatives that show or provide ways for individuals to see this eg

- Case studies or stories of individuals in new roles/how they transitioned

- Reverse mentoring

- Encouraging people to develop their transition career plans

- Supporting cross functional working on energy transition initiatives

New leaders will be needed in new areas a

Opportunities for a more diverse leadership pool

ANDChallenges to recruit as there is a scarcity of skills in new areas

SO

- Focus on looking outside the box for who

- Inclusion to realise their full potential

AND

- being comfortable with taking calculated risks

What aspiring leaders need to know

This is an opportunity

New roles in new areas means its less about technical/sector experience more about capability

85% of jobs in 2030 haven’t been created yet *

AND the traditional energy roles are still there BUT how we lead in those will change

- What leadership role do you want to play in the transition? Advocate, business leader, NED, challenger, Advisor?

- What skills and experience do you bring or want to bring? Where is your niche?

- Work out where you want to be in the next 5 to 10 years and make a plan

- Assess your strengths and areas to improve- what do you offer?

- Start working on your leadership CV

- Build your networks both inside and outside your company,

- Understand what a NED role really is and start looking for one now if that is something you want

- Reach out to those more junior than you and start mentoring them

*2018 figures from Dell technology and the institute for the future